James Hicks

Washington University

I am Associate Professor of Law and Associate Professor of Finance (by courtesy) at WashU, where my research centers on innovation law and policy.

I'm particularly interested in understanding whether and how intellectual property law affects people's incentives to create new technologies and expressive work. I also conduct empirical studies of the legal system more broadly, including projects that explore the changing nature of the Supreme Court's docket selection, and the corporate response to the #MeToo movement.

I am trained as a lawyer and social scientist, and I teach classes in intellectual property, law and economics, and empirical legal studies. I hold a Ph.D. in Jurisprudence and Social Policy and a J.D. from UC Berkeley and a B.A. in Political Science from Reed College.

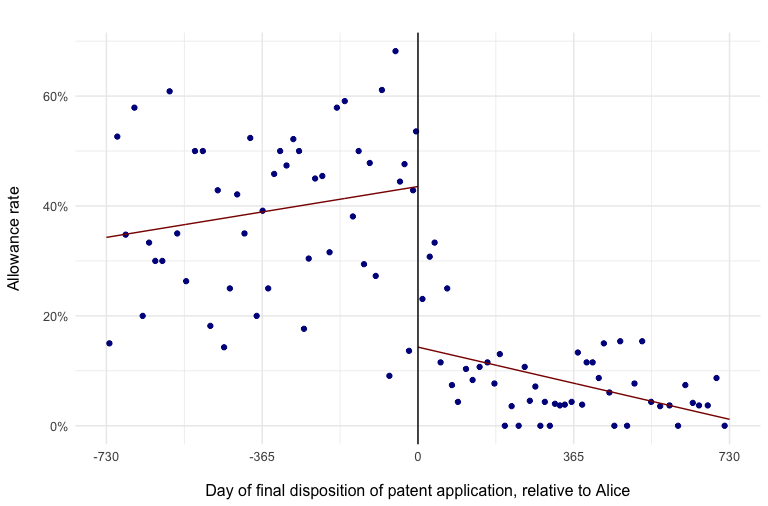

118 Northwestern University Law Review 1277 (2024)

Are patents an important factor for venture capitalists making decisions about where to invest? Past research been unable to tease out the effect of the patent itself, distinct from the quality of the invention. I use a novel quasi-experiment to show that patents play no role in channeling investment amongst early-stage software startups.

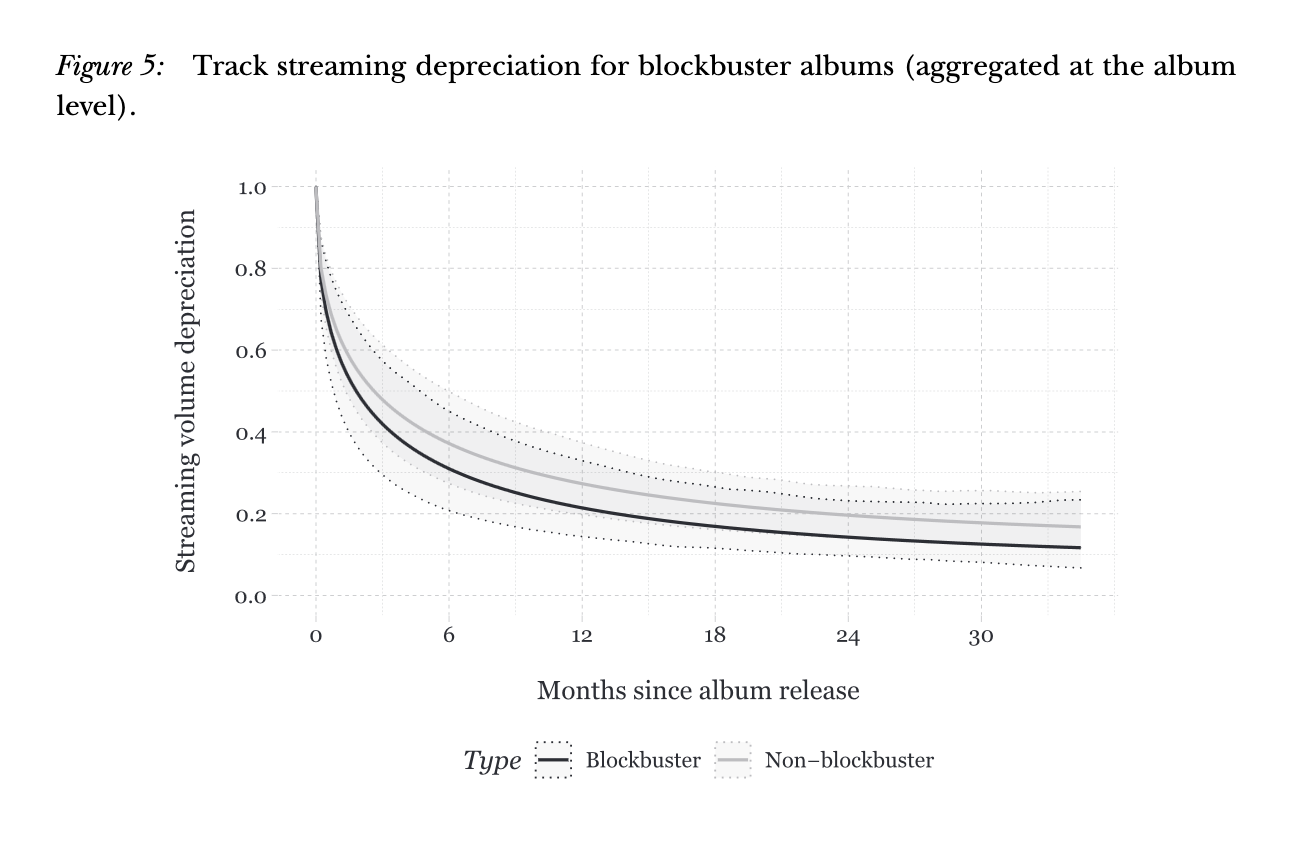

17 Journal of Empirical Legal Studies 696 (2020)

Copyright has a long term—the life of the author plus another seventy years. Does this align with the economic incentives of artists? Using data from the music industry, we find that the typical sound recording has a commercial viability on the order of months, rather than decades, and that decay rates are steep even for blockbuster songs (with Kristelia García and Justin McCrary).

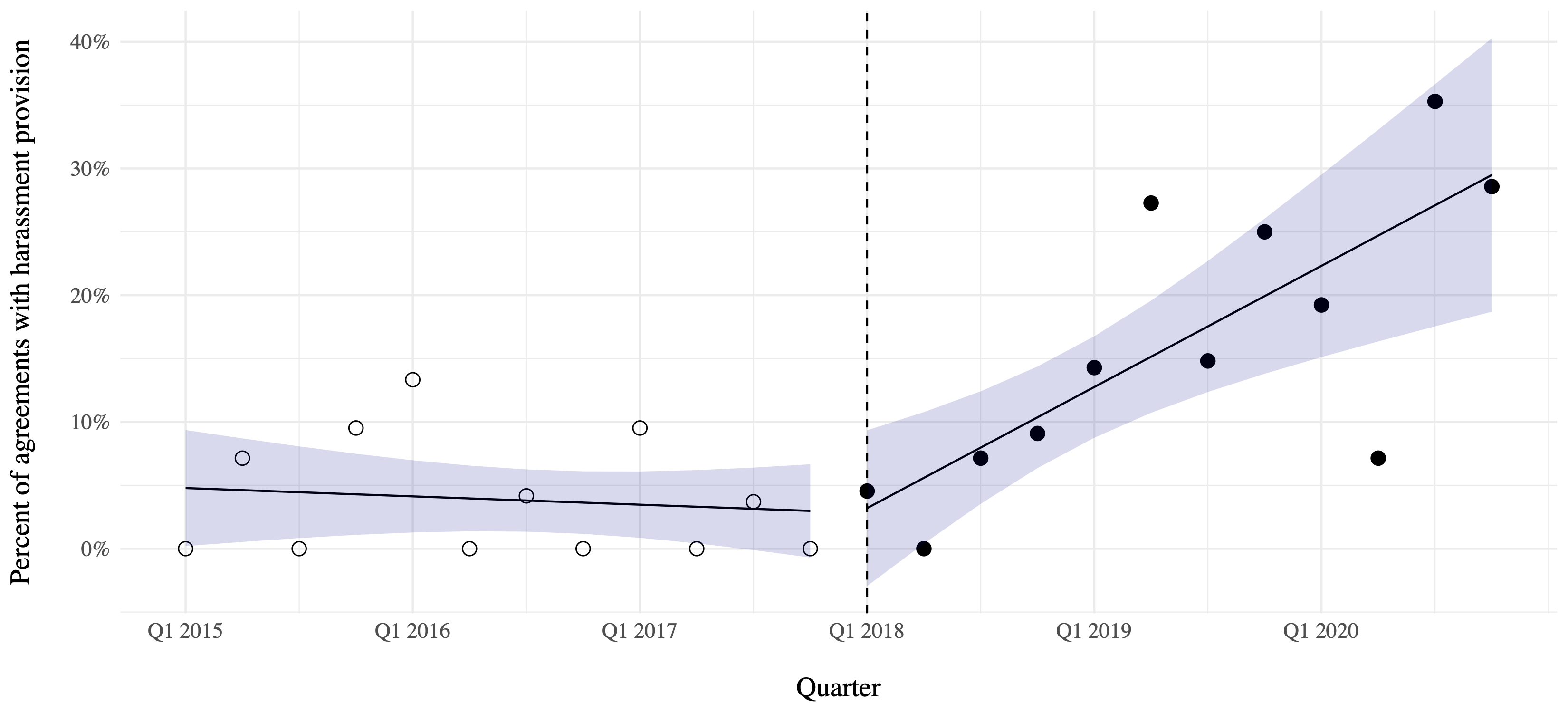

98 Indiana Law Journal 125 (2022)

Are there lasting effects of MeToo at the top of corporate America? In the wake of the movement, we find a significant and growing rise in contractual provisions that allow companies to fire CEOs without severance payouts in cases of harassment or discrimination (with Rachel Arnow-Richman and Steven Davidoff Solomon).

11 Harvard Business Law Review 113 (2021)

Public benefit corporations (“B-corps”) have received a lot of hype, but how do investors respond? We find that venture capital and private equity investors treat early-stage PBCs much like their traditional corporate peers (with Michael Dorff and Steven Davidoff Solomon).

Law & Economics Colloquium

Fall 2024, Fall 2025

Copyright

Spring 2025, Spring 2026

Survey of Intellectual Property

Fall 2025